Notices for National Health Insurance Premiums

Notices for National Health Insurance Premiums

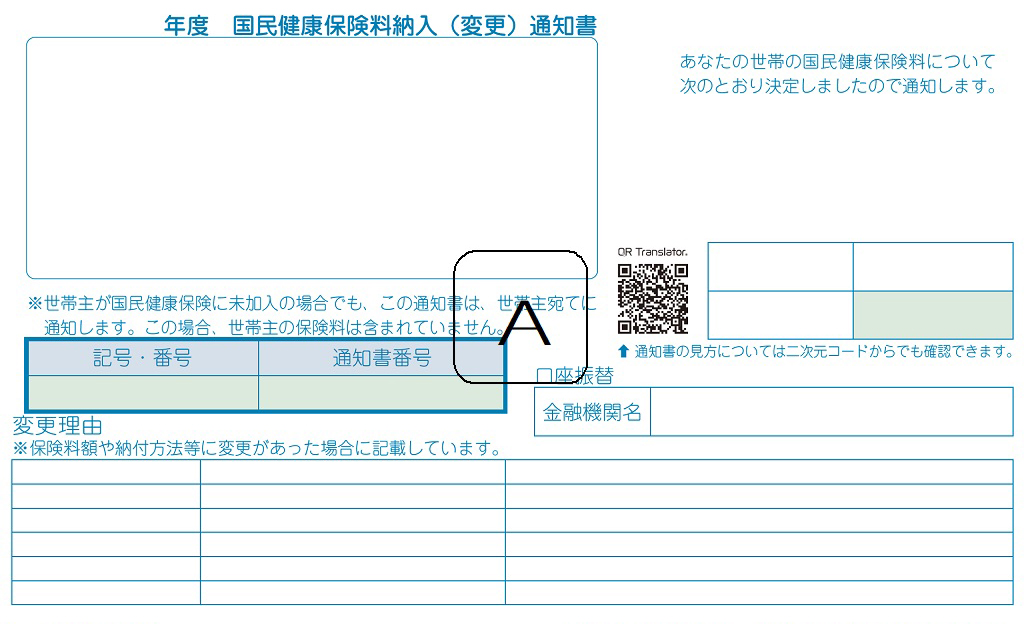

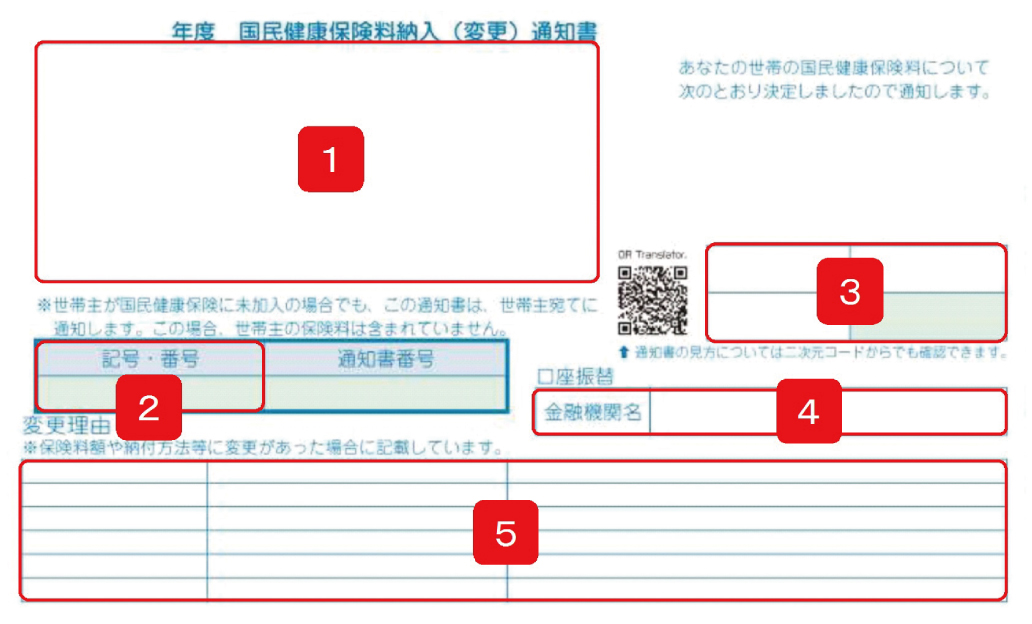

When making an inquiry, please be sure to state your Registry Number (記号・番号)

A

1Head of household

With National Health Insurance, persons are enrolled at the unit of the household, and the head of the household is the person responsible for paying premiums.

(Article 76 of the National Health Insurance Act)

This is the case even if the head of the household is not enrolled in National Health Insurance.

2Registry Number (記号・番号)

A two-part number on the insurance card assigned to the household. The Registry Number is used for administration of the household. Whenever you make an inquiry, please state the Registry Number.

3Annual insurance premium

The total amount of insurance premiums

Amount determined previous time: If your premium has changed, this figure is the total amount of your insurance premiums prior to the change. (If this is the first time for your premium to be determined, "0 (0円)," or an asterisk (*) will be displayed here.)

Amount determined this time: This figure is the total amount of your insurance premiums. (If your premium has changed, the total amount of your insurance premiums after the change will be displayed here.)

4Name of bank used for direct debit

Shows account information when direct debit is used as the payment method.

5Reasons for change

If there has been a change in the amounts of your premiums or method of collecting them, the date of the change, the names of the insured persons affected, and the reasons for the change will be displayed.

(Examples of reasons for change)

▶Enrolled in National Health Insurance

社保離脱 (Withdrawal from Social Insurance), 転入 (Moving In), 生保廃止 (Abolition of Public Assistance), 国組離脱 (Withdrawal from National Health Insurance Society), 出生 (Birth), etc.

▶Withdrew from National Health Insurance

社保加入 (Enrollment in Social Insurance), 転出 (Moving Out), 生保開始 (Commencement of Public Assistance), 国組加入 (Enrollment in National Health Insurance Society), 死亡 (Death), etc.

▶Income information changed

所得額変更 (Change in Amount of Income), 住民税更正 (Correction of Residence Tax), 被扶養者入力 (Entry of Dependent)

▶Became eligible for waiver

減免入力 (Entry of Waiver), 非自発的失業者変更 (Involuntary Unemployed Person Change), 旧被扶養者変更 (Former Dependent Change)

▶Became liable for additional premium for nursing-care component due to reaching 40 years of age

介護2号適用開始 (Commencement of Long-term Care Insurance Category 2 Application)

▶Registered household information changed

世帯合併 (Merger of Households), 世帯分離 (Separation of Households), 転居 (Domicile Change), 世帯変更 (Household Change), etc.

▶Method of collecting premiums changed

特別徴収開始 (Commencement of Special Collection), 徴収方法変更 (Collection Method Change), 特別徴収中止依頼の提出 (Submission of Request for Suspension of Special Collection), etc.

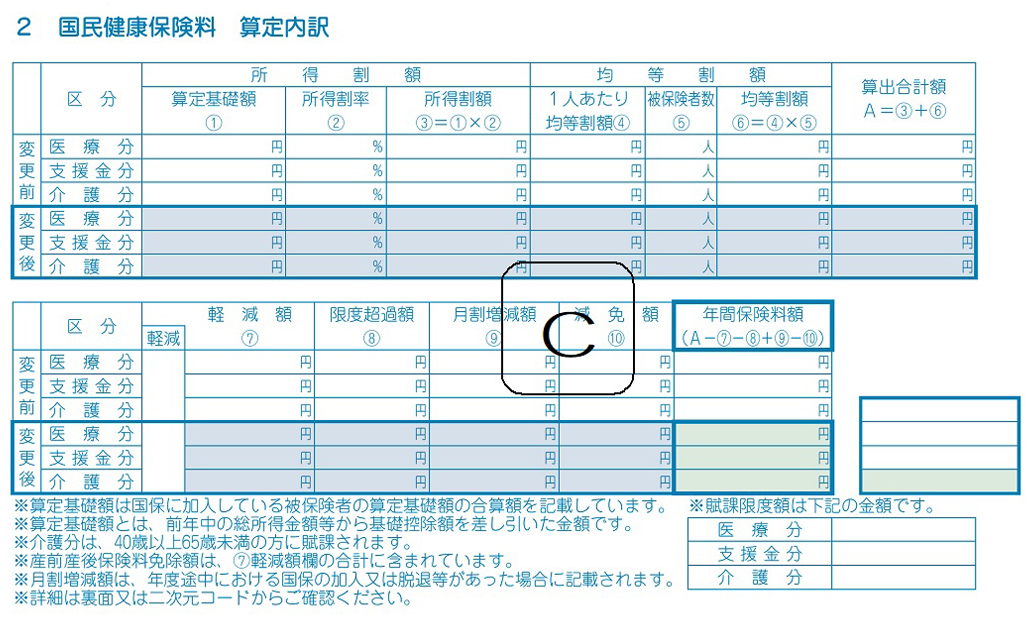

B

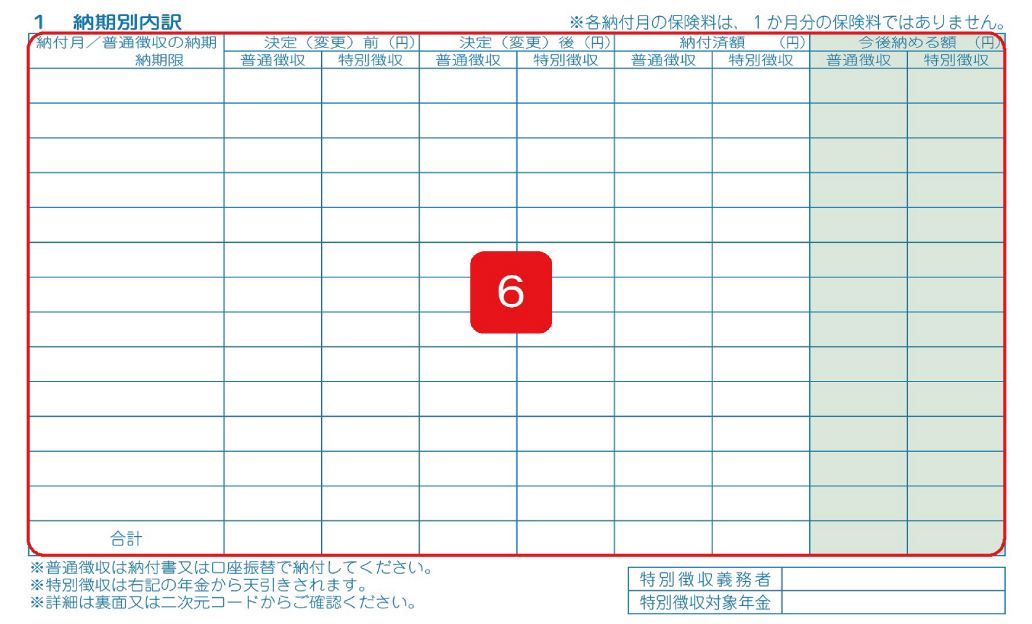

6Breakdown by due date

Shows the amount to be paid each month and the date it is due

Ordinary collection: payment slip or direct debit

Special collection: deduction from pension benefits (taken out of pension in even-numbered months)

Total: This figure is the total amount of the premiums in each payment month with ordinary collection and special collection.

Prior to determination or change (yen): If your premium has changed, this figure is the amount payable prior to the change. (If this is the first time for your premium to be determined, "0 (0円)," or an asterisk (*) will be displayed here.)

After determination or change (yen): This figure is the amount payable of premiums determined this time. (If your premium has changed, the total amount of your insurance premiums after the change will be displayed here.)

Amount already paid (yen): This figure is the amount that has been confirmed to have been paid, based on information available on the day the notice was prepared. If money that you have already paid is not included in the figure displayed here, it could be different from the "Total (合計)," so please keep that in mind.

Amount still to be paid (yen): This is the premium to be paid in that payment month. It is the "After determination or change" figure less the "Amount already paid" figure. If the amount is negative (i.e. has a minus sign next to it), this excess payment will either be refunded or allocated to premiums for which the due date has passed. (In the case of a refund, we will soon send you a refund request and direct debit request form, so please fill it out and send it back.)

Insurance premiums for past fiscal years

Fiscal years corresponding to past fiscal years' insurance premiums are shown next to "1 Breakdown by due date Fiscal 2024."

Example: Fiscal 2024 (Fiscal 2023 portion)

This means that insurance premiums for Fiscal 2023 have been charged retroactively in Fiscal 2024.

Additionally-charged insurance premiums are presented as "Past year Period XX" under Period 10.

The due dates are as shown.

These additional charges are imposed if, for example, you have enrolled in National Health Insurance retroactively or income during or prior to the previous fiscal year has come to light, meaning that premiums have been increased.

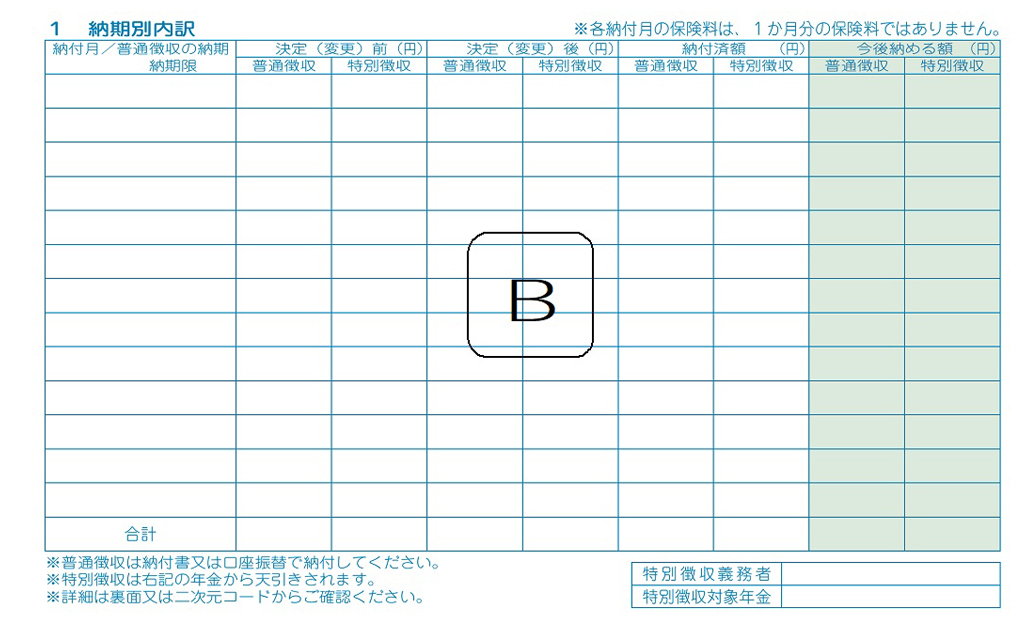

C

7Calculation basis amount

Shows the calculation basis amount for the household. If income is unknown, it shows "0円."

Note: The calculation basis amount is your total income amount etc. during the previous year less the basic deduction. Since FY2021, the basic deduction has been 430,000 yen (when the total income amount is 24 million yen or less), while in FY2020 and prior to that, it was the flat figure of 330,000 yen.

8Calculated total amount

The calculated total amount is the amount of insurance premiums for the household for April of the fiscal year concerned to March of the following year.

12 months of premiums are calculated even if you enrolled in National Health Insurance midway through the fiscal year.

Your actual premiums may be different from this figure.

9Annual amount of insurance premium

If there has been an increase/decrease compared with the calculated total amount, it will be shown in ⑦ - ⑩, and the change will be reflected in the annual amount of insurance premium.

⑦ Amount of reduction

The per-capita rate may be reduced due to such reasons as household income during the previous fiscal year having been below a certain level or preschool children being among the insured persons.

In such cases, the total amount of the reduction applied to households eligible for a reduction will be shown here.

⑧ Amount of excess

If there is an amount in excess of the maximum charges, it will be shown here.

The maximum charges are the highest annual premium that exists. A maximum charge is set for each category (medical-care component, assistance component, and nursing-care component), and it is revised every fiscal year. For the actual amounts, please refer to the payment notice.

⑨ Amount of increase/decrease in monthly amount

If, due to such reasons as enrollment in or withdrawal from National Health Insurance, there has been an increase in the number of months or persons enrolled, the amount of the increase/decrease will be shown here.

⑩ Amount of waiver

This shows the amount of waiver resulting from an application for waiver made, for example, in the case of a former dependent.

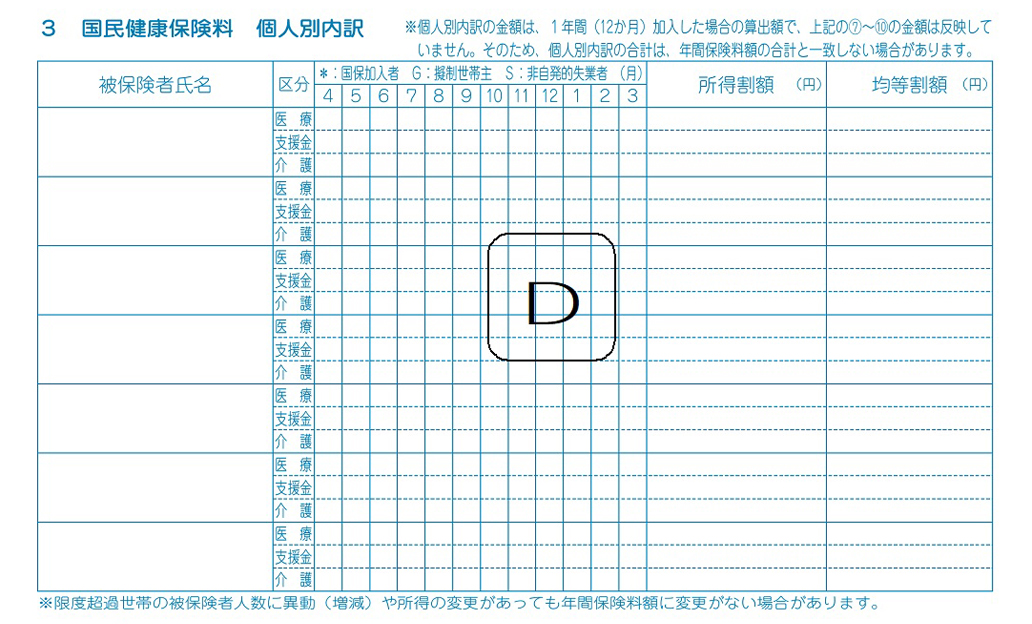

D

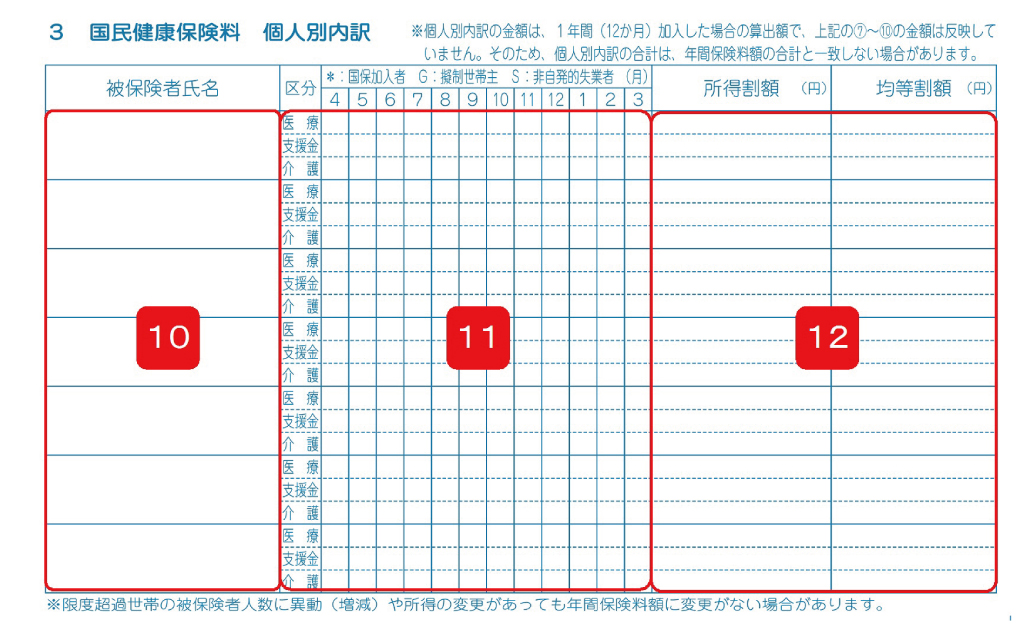

10Names of insured persons

The names of the persons enrolled in National Health Insurance (insured persons) in the fiscal year concerned are presented here.

Note: Cases where "(未就学児)" is presented in the names column

This refers to an insured person who is a preschool child in the fiscal year concerned. In the case of premiums for FY2022 and subsequent years for an insured person who is a preschool child, the per-capita rate is reduced by half. (This measure does not apply to premiums for FY2021 or earlier.)

Note: Cases where “postpartum/● months applicable” is presented next to the name’s column

This refers to an insured person who are to give birth or have given birth on or after November 1, 2023.

From the insurance premium to be paid for the fiscal year, the amount equivalent to for the period from the month before the expected month of childbirth (or the month of childbirth) to the second following month after the expected month of childbirth (or the month of childbirth) of the maternity insured will be reduced.

In the case of multiple pregnancies, the amount equivalent to the period from 3 months to 6 months prior to the expected month of childbirth (or the month of childbirth) will be reduced.

For more information on the system and procedures, please visit the Shinjuku City website.

Note: Cases where " " is presented in the names column

" is presented in the names column

This refers to a person whose income for the previous year has not been reflected due to reasons such as them not yet having filed their tax return. If there is such a person in your household, please consult the pamphlet that was contained in the same envelope as this document.

11Period of enrollment in National Health Insurance

The period of enrollment of a person enrolled in National Health Insurance is denoted by "*."

In cases such as becoming a fictitious head of household midway through the fiscal year, the months in which the person was the fictitious head of household are denoted by "G."

In the case of an insured person subject to reduction (non-voluntarily unemployed person), the period of enrollment is denoted by "S." In such a case, the calculation basis amount is 30% of employment income (income other than employment income is excluded). Premium reductions are applied for a maximum of two years from the month containing the day after leaving your job to the following fiscal year.

12Breakdown by individual

The insurance premium for each insured person is presented for reference purposes.

Note that in the case of households with an amount of excess, amount of waiver, etc., the total premiums for each insured person may not match the annual amount of insurance premium.